Well folks, I’m going to try and piece together what we know, and what we don’t know, post-Deal Dump. I’ve got to admit, this isn’t something I’ve taken much time to consider or really dive into. If I’m a little slow on the uptake here you’ll have to excuse me as I come up to speed.

Well folks, I’m going to try and piece together what we know, and what we don’t know, post-Deal Dump. I’ve got to admit, this isn’t something I’ve taken much time to consider or really dive into. If I’m a little slow on the uptake here you’ll have to excuse me as I come up to speed.

At the heart of the OCE report, which eventually led to Deal resigning to escape sanctions run for Governor, are some really basic allegations. Aside from the minor items like using the Congressional email system inappropriately, the major charges boil down to: 1.) Deal used his influence as a Congressman to protect a personally lucrative arrangement with the state and 2.) Deal broke the “rules” on earned income reported by a sitting House member.

The tax dump doesn’t really do anything to bolster or discredit number 1, but it does shed some light on number 2. The release also creates some glaring questions that will force some level of explanation from Team Deal. As Mel and Amy have already covered, the top sheets don’t provide any concrete conclusions. But they do represent a big enough red flag, particularly in 2006, that Team Deal won’t be finished with the tax questions just yet.

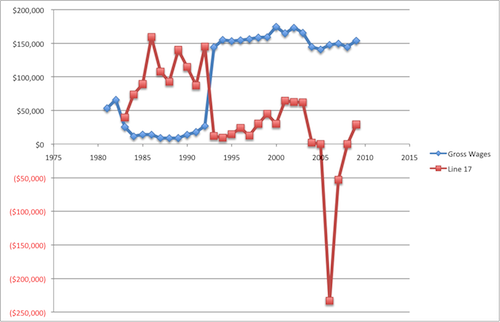

Before I dive in, let’s look at a pretty picture that informs us of how Deal has made his money the last 28 years.

I’ve pulled the 2 line items from the top sheets I think are relevant to this discussion. One is the gross wages, while the other is the income earned through Partnerships or C corps (Line 17 – presumably the GSD income).

The second biggest thing that jumps out at you on the chart is the immediate decline in partnership income at the time Deal is elected to Congress. It simply just falls off the table. I think you can draw some conclusions on why that occurred, but again, without the schedules we don’t know for certain.

I think a reasonable assumption is that, upon being elected to Congress, some arrangement is struck between Deal and his partner to defer or otherwise treat his stake in the business differently. I mean, how else could you explain an immediate drop of ~125K in annual income? Where did it go? What was the arrangement that allowed for that to happen? That is Question Number 1.

From 1992 to 1997 there is not a lot to say. You’ve got congressional pay and very modest amounts of partnership income. Then in 1998, something changes, and the partnership income spigot gets turned back on at a slower but increasing pace. This lasts until 2004, when for some as yet unknown reason, partnership income literally falls to nothing.

Then 2006 happens.

Based on the accounts from the OCE report and the tax returns, it appears that all kinds of shit hit the fan. One thing I don’t capture in the chart is that Deal sold something in 2006 and racked up some serious capital gains income (+225K worth). It was enough for Deal to file an extension and pre-pay 40K in expected tax liability. Sometime during the extension period a revelation must have occurred because Deal subsequently books a +230K loss in partnership income (bet that was a surprise to his accountant!).

This turn of events ends up netting Deal a 69K check from the IRS (29k net of the pre-pay). All kinds of tax fairness issues spark in my brain over this (e.g. treatment of capital gains vs “real” income), but that is for another day. Bottom line; some serious weirdness exists in 2006. That’s Question Number #2. WTF is this mess? What got sold, why the massive variation in what was otherwise a steady “partnership” income arrangement, and how was that loss so nice and conveniently tucked in the same year so as to offset an expected and pre-paid liability? Okay, that’s like 3 questions wrapped into one…

We also know from the OCE report that Deal had to amend his filings for 2006-2009. This was a result of the investigation (his accountant cops to this in the report). Deal, in what looks like a departure from prior practice (?), filed GSD income as “earned” income over the limits of what is acceptable for a sitting Congressman. Yep, that’s a no-no. Refile! Amy is spot on when she asks for the amendment cover sheet to be released as well.

It’s just completely jacked up and full of unanswered questions. No wonder they’ve been grinding over this in the Deal campaign.

So, if you are still with me on this, it’s clear the tax dump will not be the end of the questions. I’m sure Roy will have a handle on that. It ultimately means more time for Deal discussing a situation that is very unfavorable for him. Because while the tax dump doesn’t really help him or hurt him on the merits of the main ethics charge – using his public office to protect his personal financial interests – the tax question is enough to keep that pot stirred. For awhile.

Leave a Reply